PORTFOLIO

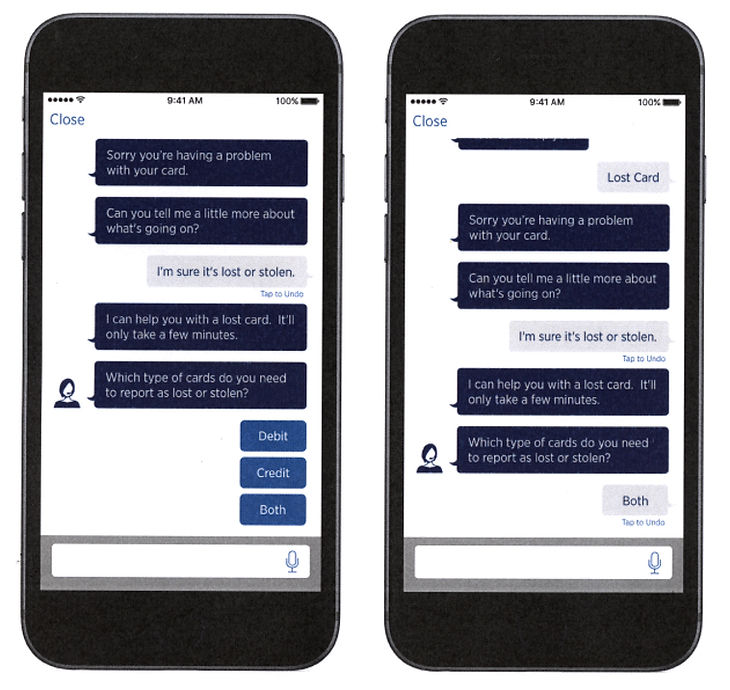

Lost or Stolen Card Experience (USAA)

-

Award winning collaboration with Bank Product CC, DC; Bank Digital CC, DC; Legal; Compliance; Fraud; Bank IT Lead CC; Bank IT Lead DC; 3 Dev Teams; Nuance 3p vendor.

-

Pushing beyond the norm, content co-creation.

-

This award winning experience was born out of a hypothesis my colleague wanted to prove out for our Virtual Agent. The lost or stolen card experience had a historically low completion rate of around 55-60%. There are many reasons why that is the case, but he wanted to build this experience in our Virtual Agent as the first fully end-to-end transaction, with a theory that it will outperform all other platforms due to the conversational nature of the experience.

-

Thus, the project was handed over to me to bring it to life. This project broke records for cross-company collaboration, as I had to gather requirements and review the design with a very wide range of stakeholders such as Bank Digital and Product Managers for Credit Card, Debit Card, Youth Cards, Legal and Compliance points of contact for both Debit and Credit Card teams, Fraud, Bank IT Leads for both Credit Cards and Bank IT Leads for Debit Cards, 3 development teams, and ensure that each data point and every new element of visual design required for the experience could be relayed to and from our 3rd party vendor who hosts our agent. Not to mention grammar creation, concept mapping so members can say “I lost my credit card” and we’d automatically filter their card list to only display the credit cards on file (as a fractional example of the NLU comprehension built in).

-

As I was analyzing the digital experience that already existed in the mobile app and on USAA dotom, I realized that you could not build Lost or Stolen Card without also including the Block or Unblock a card functionality. When you initially want to report a card as lost or stolen, we ask if they are still looking for their card or if they’re sure it’s lost or stolen. If they are still looking for the card, it’s best that they block the card and if found, they can simply unblock it and it’s as if nothing happened. The benefit being that while the card is not in their possession, any transactions that are not already pending will be declined - just in case someone else found the card and tried to use it. It was also around this time that Discover had a heavy marketing push for being able to “put a freeze” on your card. We did some analysis and sure enough members were asking us if they could freeze their card, but we called it “blocking a card”. So as the design moved forward, I was sure to include “freeze my card”, “freeze my debit card”, “freeze my credit card” and many other variations into the grammar set, so we’d recognize what the members were asking for to help them get where they needed to go.

-

After requirements were gathered, I was able design the experience using Nuance Application Studio, a design tool which allows you to craft extremely detailed designs that accommodate a multitude of variables and “if then” statements. I began with crafting user journeys of the “happy paths” the design could take and what pieces of data I’d need to have a full on “lost wallet” experience.

-

The tool is close to code in nature, but doesn’t deploy the design. From the tool you can generate content flows (similar to Visio designs), content or user journeys, and intensely detailed word documents with hyperlinks to jump you to different portions of the design. This design generated 33 different user journeys to cover each scenario. These journeys were used to collaborate with our producer, visual designers, 3 development teams, and others on our agile team to bring the design to life visually.

-

There’s so much to this story, many “newly discovered” requirements along the way, pivoting, unexpected delays, and close relationships built that made this project successful. At the same time, there were some who couldn’t see the vision, had doubts, and could not understand how you could pull a piece of functionality out of an experience and make it it’s own to reduce mental friction for the member. However, I knew it could be done and pushed forward.

-

Ultimately, when we were able to measure the performance, it was in line with banks’ lost stolen digital performance on dotcom and mobile, but the Virtual Agent’s Lost/Stolen volume and completion rates were significantly higher than the Voiceline equivalent.

-

Between this Virtual Agent experience, programming the grammar to recognize that asking to “freeze a card” is the same as asking to “block a card”, and the subsequent work the bank did to streamline their experience, we won the Most Beautiful Experience from Bank and the Chief Design Office for Blocking and Unblocking Cards and the design was a major factor in USAA winning banking app of the year.